|

GUANGZHOU, China, July 18, 2024 /PRNewswire/ -- On July 12th, it was announced that 91 additional ETFs will be added to the Mainland China-Hong Kong ETF Connect Program, which will take effect on July 22nd. This expansion brings the total number of ETFs in the program to 241, with 19 of them being managed by E Fund Management ("E Fund"), the largest fund manager in China. In meantime, a significant increase in foreign investors' demand for tech investment opportunities was observed, with the electronics sector being the most popular – the northbound fund inflows into the sector reached US$1.58 billion in the second quarter.

After the expansion, offshore investors with interests in tech innovation can leverage enriched investment tools – more than 20 thematic ETFs, including three from E Fund, namely E Fund CSI Artificial Intelligence Thematic ETF (Code: 159819), E Fund CSI Cloud Computing & Big Data Index ETF (Code:516510), and E Fund CSI Technology 50 Index ETF (Code:159807).

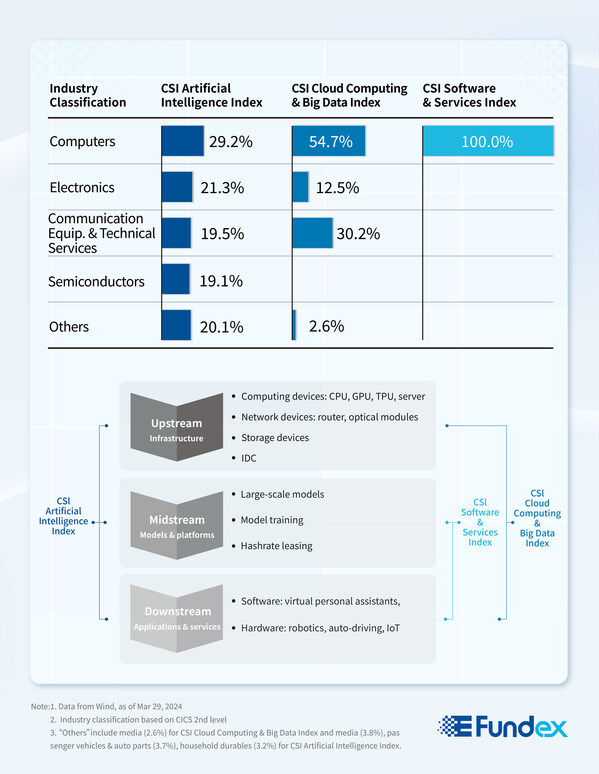

The CSI Technology 50 index offers exposure to 50 large companies listed on both the Shanghai and Shenzhen Stock Exchange, with 59% of its shares in information technology and communication services sectors. The other two indexes aim to track different segments along the AI value chain in China, consisting of infrastructure, models and platforms, applications and services.

While the CSI Artificial Intelligence Index covers the entire AI value chain, with computers, electronics, and communication equipment and technical services industries as the top three, the CSI Cloud Computing & Big Data Index focuses on upstream computing devices and downstream applications, with over 50% exposure to the computers industry.

Among the ETFs tracking these indexes, E Fund CSI Artificial Intelligence Thematic ETF and E Fund CSI Cloud Computing & Big Data Index ETF are the largest of their kind, with a net asset of US$798 million and US$153 million, respectively, as of July 15th.

About E Fund

Established in 2001, E Fund Management Co., Ltd. ("E Fund") is a leading comprehensive fund manager in China with close to RMB 3.3 trillion (US$ 454 billion) under management. It offers investment solutions to onshore and offshore clients, helping clients achieve long-term sustainable investment performances. E Fund's clients include both individuals and institutions, ranging from central banks, sovereign wealth funds, social security funds, pension funds, insurance and reinsurance companies, to corporates and banks. It is a pioneer and leading practitioner in responsible investments in China and is widely recognized as one of the most trusted and outstanding Chinese asset managers.

Note: As at Jun 30, 2024. AuM includes subsidiaries. Source: PBoC, Wind.

source: E Fund Management

【與拍賣官看藝術】走進Sotheby's Maison睇睇蘇富比旗艦藝廊!蘇富比如何突破傳統成規?► 即睇