|

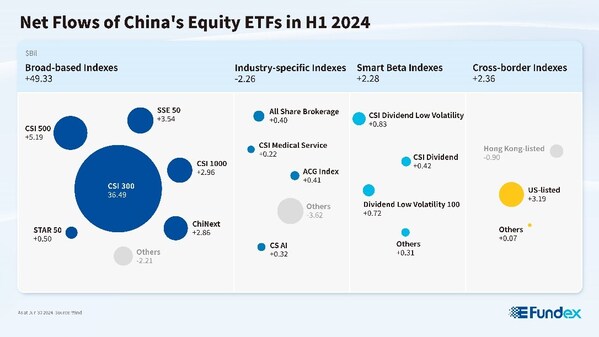

GUANGZHOU, China, July 5, 2024 /PRNewswire/ -- In the first half of 2024, the A-share ETF market scaled a new record high and the market size surpassed US$292 billion, with broad-based ETFs as the main driving force. According to Wind, the assets of broad-based ETFs doubled from US$83 billion in mid-2021 to over US$171 billion, increasing their share from 41% to 59%. Meanwhile, 25 fund companies launched a total of 84 stock ETFs, an increase of 27 from the same period last year, with a combined initial offering size exceeding US$5.8 billion. Among them, E Fund, the largest fund manager in China, topped the market with ten new ETF launches[1] and over US$505k in fundraising.

A-share broad-based ETFs led the way with US$54.4 billion in net inflows, taking up more than 90% of the total net inflows. The top 10 ETFs were all broad-based, reflecting the performance of indexes such as the CSI 300, CSI 500, SSE 50, CSI 1000, ChiNext, and STAR 50. The E Fund CSI 300 ETF (Code: 510310) ranked first in terms of fund flows. Additionally, 23 broad-based ETFs have been launched, with CSI A50 ETF being the most favored. Ten ETFs tracking the CSI A50 index, including E Fund CSI A50 ETF (Code: 563080), gathered nearly US$2.3 billion, accounting for almost 40% of the new issuance this year.

On the other hand, high dividend yield ETFs attracted continuous inflows of approximately US$2.1 billion, backed by strong returns. The CSI Dividend Total Return Index and CSI Dividend Low Volatility Total Return Index delivered gains of 11% and 15% respectively. Riding on this momentum, fifteen high dividend yield ETFs were introduced in the first six months of this year, covering high dividend yield assets listed in A-share and Hong Kong stock markets. Notably, E Fund rolled out E Fund Hang Seng SCHK High Dividend Low Volatility ETF (Code: 159545) in March, which tracked the performance of companies listed in Hong Kong and included in Stock Connect, adding to the diversity of onshore investors' portfolios.

About E Fund

Established in 2001, E Fund Management Co., Ltd. ("E Fund") is a leading comprehensive fund manager in China with close to RMB 3.3 trillion[2] (US$ 454 billion) under management. It offers investment solutions to onshore and offshore clients, helping clients achieve long-term sustainable investment performances. Long-term oriented, it has been focusing on the investment management business since inception and believes in the power of in-depth research and time in investing. It is a pioneer and leading practitioner in responsible investments in China and is widely recognized as one of the most trusted and outstanding Chinese asset managers.

Note:

[1] Launch means the fund contract comes into effect. |

[2] As at Jun 30, 2024. AuM includes subsidiaries. Source: PBoC, Wind. |

source: E Fund Management

樂本健【年度感謝祭】維柏健及natural Factors全線2件7折► 了解詳情