NEWS RELEASE

Wood Mackenzie launches Lens Metals & Mining

The new data analytics solution for strategic workflows and corporate decision-making

LONDON 01 October 2024 – Wood Mackenzie, the global insight business for renewables, energy, and natural resources, has launched Lens Metals & Mining, a cross-commodities data analytics platform. This solution allows analysis of key mined commodity markets and assets within the energy and natural resource value chain.

Wood Mackenzie's Lens Metals & Mining is the latest addition to the Lens data analytics platform. It provides access to immediate data and insights from a global team of industry experts with in-depth knowledge and experience across the energy, chemicals, metals, and mining value chain. The latest solution provides an end-to-end data analytics solution to explore all data, insights and modelling capabilities, to help understand market drivers, derive immediate insights, quantify risk, and identify opportunities.

“As customers are looking for market intelligence, benchmarking against their peers, screening for bankable mining opportunities, or conducting valuation, Lens is specifically designed for these strategic workflows,” said Derryn Maade, Head of Metals and Mining Markets at Wood Mackenzie. “This seamless experience integrates Wood Mackenzie’s renowned expertise and cross-commodities data to enable faster, more accurate operational and strategic planning”.

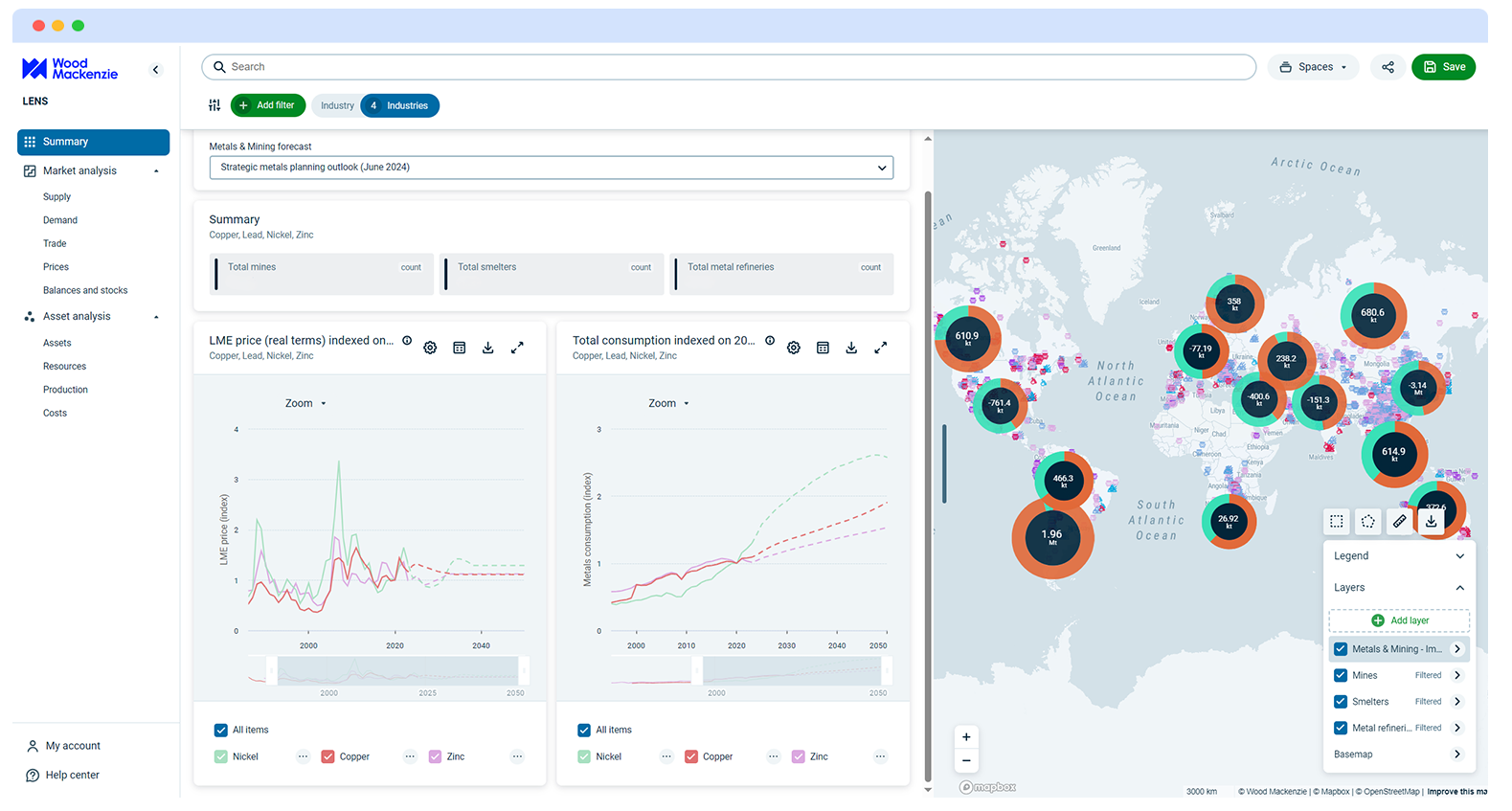

Wood Mackenzie Lens Metals & Mining data analytics platform

Source: Wood Mackenzie Lens Metals & Mining

As the energy transition accelerates, the demand for critical raw materials will reach an all-time high. The metals and mining industry has reached a crucial moment, and the need for investment has become undeniable.

Added Lindsay Grant, Vice President, Head of Metals and Mining Markets Research, “Making confident investment decisions requires reliable data and market insights to discover the optimal opportunities, mitigate risk, conduct accurate valuations, and deploy capital sustainably and profitably. With integrated workflows, the Lens platform enables users to assess risk and pinpoint opportunities, helping them navigate a rapidly changing and volatile market and its impact on investments”.

For more information about Lens Metals & Mining, visit https://www.woodmac.com/lens/metals-and-mining/" target="_blank">https://www.woodmac.com/lens/metals-and-mining/

ENDS

Editor’s Notes:

About Wood Mackenzie Lens®

Wood Mackenzie’s Lens® platform is the industry standard in critical decision-support, harnessing the power of digital technology to provide answers to complex questions across the natural resources value chain, enabling customers to manage their capital, operations, and processes swiftly and efficiently. https://www.woodmac.com/lens/

Lens Metals and Mining for Copper, Nickel, Lead and Zinc are available at Lens® platform. By the end of 2024, more commodities will be available.

For further information please contact:

Hla Myat Mon

PR Manager - APAC

+65 8533 8860

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That’s why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years’ experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers’ decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

source: Wood Mackenzie

【香港好去處】2025去邊最好玩?etnet為你提供全港最齊盛事活動,所有資訊盡在掌握!► 即睇