Vancouver, BC, Nov 26, 2024 - (ACN Newswire) - Q2 Metals Corp. (TSXV:QTWO)(OTCQB:QUEXF)(FSE:458) (" Q2 " or the " Company ") is pleased to announce that it has acquired a 100% interest in 545 mineral claims (the "Additional Cisco Claims"), more than tripling its mineral claim position at the Cisco Lithium Property (the " Property " or the " Cisco Property ") located within the greater Nemaska traditional territory of the Eeyou Istchee James Bay region of Quebec, Canada.

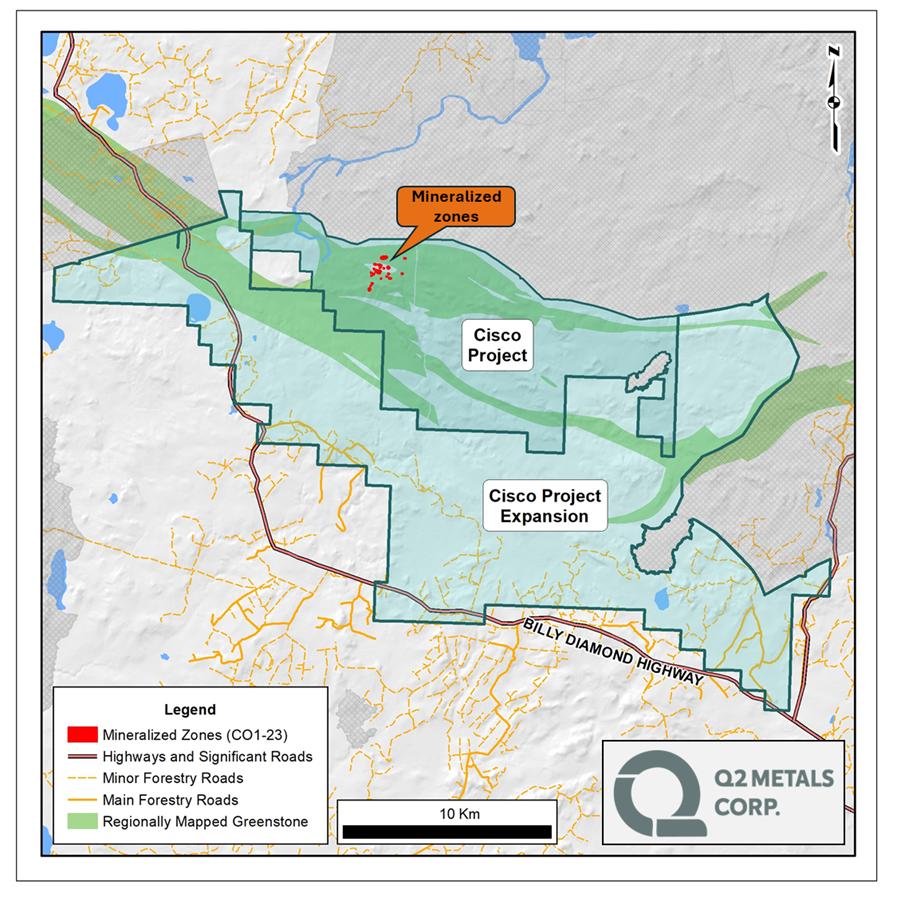

The Cisco Property is now comprised of a total of 767 contiguous mineral claims over 39,389 hectares ("ha"), including more than 30 kilometres ("km") of strike length on the Frotet-Evans Greenstone Belt, which hosts the Sirmac and Moblan lithium deposits, located 130 km and 180 km away, respectively. The Additional Cisco Claims are primarily south of the original Cisco Property claims, adding several kilometres of prospective greenstone rocks and providing extensive strategic sites for future development and mining infrastructure scenarios.

"We couldn't be more pleased to have acquired these additional claims ," said Q2 Metals President and CEO Alicia Milne. " Since acquiring Cisco, we have been able to clearly demonstrate its world-class potential for grade and scale, while also focusing on key future development pathways. These additional claims provide us with a major footprint in an emerging, top lithium jurisdiction and provides us exceptional optionality for future development. "

Neil McCallum, Vice President of Exploration for Q2 stated, " While we eagerly await the pending release of remaining assay results from the lab, we have been focused on planning our winter 2025 exploration program. These additional claims add a tremendous amount of mineral prospectivity at Cisco as they include more of the greenstone belt that has been our focus this year and which has yielded such tremendous success. As we approach year end, we're looking forward to further updates and a very busy 2025. "

Additional Cisco Claims - Acquisition Terms

The Additional Cisco Claims were acquired pursuant to an option agreement dated November 26, 2024, between Q2 Metals, 9490-1626 Quebec Inc. (" CMH ") and Anna-Rosa Giglio (together with CMH, the " Vendors "). To acquire the Additional Cisco Claims,the Company must pay to CMH an aggregate of $2,400,000 over a period of 42 months and complete $1,200,000 of exploration expenditures during that time:

Closing date | $150,000 |

|

3 Month Anniversary of Closing Date | $150,000 |

|

6 Month Anniversary of Closing Date | $300,000 |

|

12 Month Anniversary of Closing Date | $300,000 | $335,000 |

18 Month Anniversary of Closing Date | $300,000 |

|

24 Month Anniversary of Closing Date | $300,000 | $325,000 |

30 Month Anniversary of Closing Date | $300,000 |

|

36 Month Anniversary of Closing Date | $300,000 |

|

42 Month Anniversary of Closing Date | $300,000 | $540,000 |

Total | $2,400,000 | $1,200,000 |

Upon satisfaction of the above payments and expenditures, the Company will earn a 100% interest in the Additional Cisco Claims.

The Vendors will retain a 3% gross metals returns royalty (the " GMR ") on the Additional Cisco Claims except the Soquem Claims (as defined below), of which up to 2% of the GMR may be purchased by the Company at any time prior to commercial production for $1,000,000 on the first 1% and $2,000,000 on the next 1%. The foregoing GMR purchase payments may be satisfied in either cash or Common Shares, at the election of the Company and subject to regulatory approval. Certain of the Additional Cisco Claims (the "Soquem Claims") bear a 2% net smelter returns royalty (the " NSR ") in favour of Soquem Inc. Upon closing, the Company will assume the rights and obligations under the NSR, which include the right to repurchase 1% of the NSR for $500,000. In addition, the Company will grant the Vendors a 1% GMR on the Soquem Claims. The Vendors will also be paid a bonus of $2,500,000 on the completion and delivery of an initial mineral resource calculation report, prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects, on the Additional Cisco Claims demonstrating an inferred resource (or higher category) of at least 25 million tonnes grading over 1% Li2O. Closing of the Agreement is subject to certain terms and conditions.

Qualified Person

Neil McCallum, B.Sc., P.Geol, is a registered permit holder with the Ordre des Géologues du Québec and Qualified Person as defined by NI 43-101 and has reviewed and approved the technical information in this news release. Mr. McCallum is a director and VP Exploration for Q2.

About Q2 Metals Corp and the Cisco Property

Q2 Metals is a Canadian mineral exploration company focused on unlocking its portfolio of lithium projects in the Eeyou Istchee James Bay region of Quebec, Canada, that includes both its 100-per-cent-owned flagship Cisco Lithium Property and Mia Lithium Property.

The Cisco Property is comprised of 767 claims totaling 39,389 ha within the greater Nemaska Community lands of the Eeyou Istchee Territory, James Bay, Quebec and is approximately 150 km north of the town of Matagami and its rail infrastructure. The Billy Diamond Highway, which transects the property, is only 6.5 km away from main mineralized zone.

Cisco is situated along the Frotet Evans Greenstone Belt, comprised of a volcanic package dominated by mafic to felsic metavolcanic rocks, of the southern James Bay Lithium District, the same belt that hosts the Sirmac and Moblan lithium deposits, located 130 km and 180 km away, respectively.

Since May 2024, the Company has drilled a total of 6,359.7 m over 17 holes at the Cisco Lithium Property. All drill holes intercepted pegmatite with visual indications of spodumene mineralization identified. Drill results include:

120.3 metres at 1.72% Li 2 O (hole CS-24-010);

215.6 metres at 1.69% Li 2 O (hole CS-24-018); and

347.1 metres at 1.35% Li 2 O (hole CS-24-021)

FOR FURTHER INFORMATION, PLEASE CONTACT:

Alicia Milne | Jason McBride |

Telephone: 1 (800) 482-7560

E-mail: info@Q2metals.com

Follow the Company: Twitter , LinkedIn , Facebook , and Instagram

Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian legislation. Forward-looking statements are typically identified by words such as: "believes", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "would", "will", "potential", "scheduled" or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. Accordingly, all statements in this news release that are not purely historical are forward-looking statements and include statements regarding beliefs, plans, expectations and orientations regarding the future including, without limitation, any statements or plans regard the geological prospects of the Company's properties and the future exploration endeavors of the Company. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in such forward-looking statements. The forward-looking statements in this news release speak only as of the date of this news release or as of the date specified in such statement. Forward looking statements in this news release include, but are not limited to, that the Additional Cisco Claims may provide for extensive strategic sites for future development and mining infrastructure scenarios, drilling results on the Cisco Property and inferences made therefrom, the grade and scale of the Cisco Property being world class, that the Cisco Property is in an emerging top lithium jurisdiction, that the Additional Claims provides exceptional optionality for future development and mineral prospectivity, that the Additional Cisco Claims will add a tremendous amount of potential at Cisco, the focus of the Company's current and future exploration and drill programs, the scale, scope and location of future exploration and drilling activities, the Company's expectations in connection with the projects and exploration programs being met, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, variations in ore grade or recovery rates, changes in project parameters as plans continue to be refined, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same. Readers are cautioned that mineral exploration and development of mines is an inherently risky business and accordingly, the actual events may differ materially from those projected in the forward-looking statements. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for its recently completed fiscal period, which is available under Company's SEDAR profile at www.sedarplus.ca .

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Q2 Metals Corp.

Copyright 2024 ACN Newswire. All rights reserved. www.acnnewswire.com