|

LONDON, June 13, 2024 /PRNewswire/ -- According to Omdia's latest report, the global market for OLED materials is poised for a rebound after experiencing a deficit in recent years. The findings from Omdia's latest 'OLED Materials Market Tracker – 2Q24C' released in June, indicate a shift in trajectory. While OLED materials had been on a steady growth path until 2021 driven by the rapid expansion of OLEDs in the display market, they encountered a decline for the first time in 2022. However, Omdia's analysis shows a resurgence in growth for OLED materials, signaling a promising outlook for the industry.

Jimmy Kim, Ph.D. and Senior Principal Analyst at Omdia explained, "The decline was primarily due to sluggish end-market sales of OLED TVs. The OLED TV's larger unit area compared to other OLED applications results in higher material consumption during manufacturing. Despite OLED TV shipments being relatively low, their share in total OLED material consumption is significant."

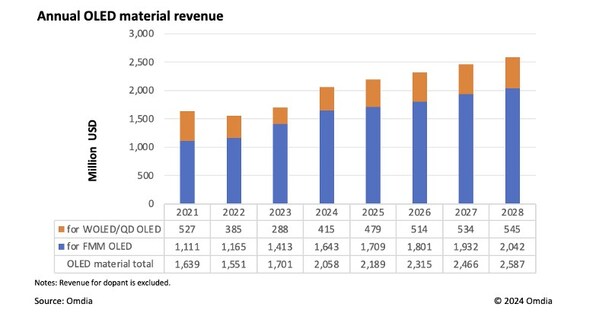

The chart illustrates a substantial revenue decline for WOLED/QD OLED while the revenue for FMM RGB OLED remained reasonably stable.

In 2023, OLED materials revenue experienced a slight increase but only reached levels similar to those of 2021. Kim noted, "The end-market demand for OLED TVs has yet to fully recover from the previous year."

The utilization of WOLED fabs appears to be improving this year. According to Omdia's 'OLED and LCD Supply Demand & Equipment Tracker – 4Q23', the utilization of LGD's Paju E4 line rebounded to over 60% in 1Q24 following a low of 33% at the end of 2022. LGD's WOLED line in Guangzhou also saw utilization rise to over 50%. Additionally, Samsung Display plans to maintain the operation of its QD OLED fab at over 70% during the first half of 2024. "Consequently, we anticipate a significant increase in OLED materials revenue for WOLED/QD OLED this year.", Kim noted.

In contrast, material revenue for FMM RGB OLED has shown robust growth since 2023. This growth is attributed to increased material demand for Apple's latest iPad models complemented by sustained revenue from traditional iPhone displays. Additionally, Chinese manufacturers are increasing their consumption of OLED materials to meet local display demand. This trend is expected to prevent a decline in overall OLED material consumption and drive strong growth in the coming years. According to Omdia's forecast, that annual OLED materials revenue (excluding dopants revenue) is projected to exceed $2billion this year and is set to reach $2.6billion by 2028.

ABOUT OMDIA

Omdia, part of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Fasiha Khan Fasiha.khan@omdia.com

source: Omdia

樂本健【雙12感謝祭】雙重優惠.賞完再賞► 了解詳情